An Aging Population May Not Spell Catastrophe for the US Economy

Even with worries about social security and a decline in workforce numbers, an aging US population may not ruin the US economy because of more capital for workers and potential immigration.

Highlights

- According to the US Census Bureau, about a quarter of the US population will be of retirement age by 2060 — up from 15% in 2016 — which may spur a forecasted 5.5% dip in the gross domestic product (GDP).

- An aging population also drives lower labor force participation — the percentage of adults who work.

- Only about a third of US retirees’ assets come from government programs like social security compared to nearly 100% of assets in European countries, providing economic resilience for an aging population.

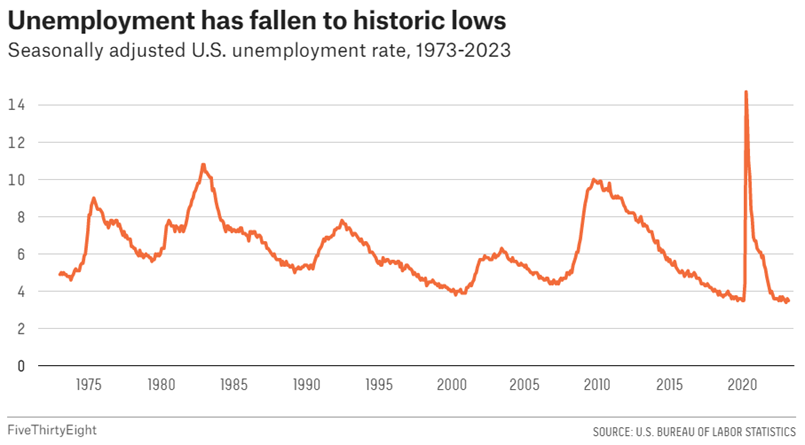

The American economy is roaring and robust. For perspective, look at the unemployment rate, which shows the share of the population looking for work who haven’t found any. It’s fallen to its lowest level in 50 years.

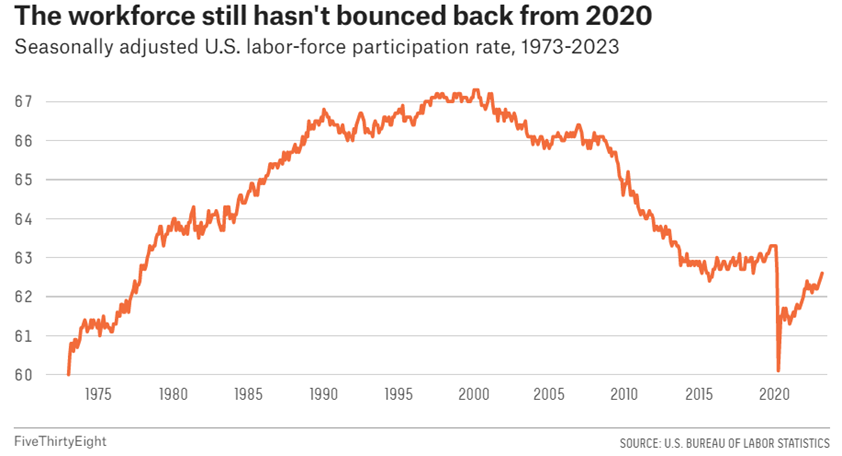

While unemployment is strikingly low, the labor force participation rate — the share of Americans in the labor force — was 62.6% as of March 2023. This percentage is considerably lower than its peak around the year 2000 at 67.3%.

A sort of contradictory situation exists here. We have a thriving economy with low unemployment, yet still have a relatively low percentage of adults working. The percentage of Americans working is giving some economists headaches, the reason being that the low labor force participation rate gets at the foundation of growing concern for the American economy: an aging populace.

Lower Labor Force Participation May Not Doom the American Economy

As in other developed countries, Americans are living longer and having fewer children. In recent decades, this has led to a shrinking pool of workers, along with a sprouting group of Americans entering retirement. According to a recent Congressional Budget Office estimate, the number of Americans aged 65 or older is expected to grow faster than the population in prime working age — between 25 and 54. Another estimate from the US Census Bureau projects that by 2060, nearly a quarter of all Americans will be of retirement age, up from 15% in 2016. Moreover, the Census Bureau anticipates that the labor force participation rate will continue to wane over the coming decades. As such, most US economy projections forecast that the US economy will grow at a much slower rate in the coming decades compared to the last century.

“We’ve basically been in a plateau for the last 10 years, as the strengthening economy has been offset by this downward pull from aging,” says Harris Eppsteiner, who has previously worked as a research economist for the White House’s Council of Economic Advisers, in a press release.

Synergistically, those two forces, the economy’s prowess along with the downward pull from aging, suggest that fewer Americans will be working in the coming decades. Some economists fear this will create a potentially corrosive burden on the US economy and welfare system. What’s unclear, though, is how significant of an impact this will have on the American economy’s future. However, the good news is that the US has ample time to come up with an approach to deal with an aging population. What’s more, its existing welfare system is surprisingly resilient to economic change.

A fairly reliable body of research suggests that a country’s aging populace has a negative impact on overall economic growth. For example, a 2016 paper from the National Bureau of Economic Research found that a 10% increase in the population’s share above age 60 reduces growth in per capita GDP by 5.5%. Thus, this kind of boom in the population’s share above retirement age means a reduction in the working-age population along with a lower GDP.

An aging population also makes the measurement of economic recovery difficult, perhaps even obscuring gains. For example, during the Great Recession of the early 2000s, the American Labor Force lost almost 2 million workers due to aging alone.

“By the beginning of 2019, [labor-force participation] was still meaningfully lower than it was in the fourth quarter of 2007,” says Eppsteiner. “So naively, you could say, ‘Well, the economy has a really long way to go [to get back to pre-recession levels],’ … but what we’re trying to point out was, well, no, because we have this demographic transition happening. So you need to account for that.”

According to Ronald Lee, a professor of demography and economics at the University of California, Berkeley, the biggest issue for America’s aging population isn’t its declining GDP. He believes the biggest problem will be how it might affect the distribution of the nation’s resources.

“It becomes a problem because of our systems and arrangements for redistributing income to different ages in the population,” Lee said. “It’s more about how we distribute the pie, rather than how big the pie is.”

The transition to a population with more retirees presents a few problems for the existing order. As a consequence of the aging population, more people entering retirement could mean a burdened welfare system from more people tapping into social security than those paying into it. More younger Americans would need to pay more into the system through higher taxation, receive less benefits, and/or retire at later ages to maintain this system. This scenario doesn’t mean that the American economy or even its welfare system are doomed from an aging population.

An Aging Population May Increase Wages, Consumption, and Productivity

In fact, although an aging population may trigger a decline in the overall economic growth, per capita wages, consumption, and productivity may actually rise. This may be the case, because an aging population means more capital per available worker, assuming savings rates remain the same.

Some economists even argue that an aging population may be an opportunity for growth and innovation in the US economy. Jim Johnson, a professor of strategy and entrepreneurship at the University of North Carolina, Chapel Hill, says that if viewed as an asset, the more than 70 million baby boomers could help drive the development of the “longevity economy,” what the economy will look like to accommodate an aging population. The “longevity economy” could have the added benefit of helping the millions of workers who lost employment during the pandemic to regain employment.

“We have [millions of] baby boomers, turning 65, at the rate of 10,000 per day, every day, seven days a week … a lot of them are working much longer past age 65, and they are major consumers in the marketplace,” says Johnson. “Given the labor market challenges that we’re facing today, post-COVID, ‘encore careers’ are something that we’re going to have to pursue in a major way.”

Policymakers can also dampen the effect of an aging population on the US economy. One widely accepted way to mitigate these effects comes from boosting immigration, particularly among younger groups. Higher immigration rates help countries with aging populations, because immigrants are typically younger and therefore more able to work than the domestic population. Along those lines, American economic forecasts tend to assume that by 2030, population growth from immigration will supersede that from natural increases (births minus deaths).

Moreover, social security, which has come under fire due to the uncertainty of its future funding, may not be in such a high degree of jeopardy. According to Lee, what sets the US apart from European countries is the share of income that older residents draw from assets, rather than government transfers. This means that the US economy is possibly more insulated from the disruptive shift toward an aging population.

“In the U.S., on average, about two-thirds of income and consumption [for the elderly] is coming from asset income, and only about a third for the elderly is coming from Social Security,” Lee says. “But if you look at other countries, particularly European countries, it’s not uncommon to have close to 100 percent of old age consumption funded by public transfers.”

An Aging Population May Give Aged Consumers More Economic Influence

Perhaps the biggest takeaway from America’s aging population is that there is no settled conclusion on how it will affect the economy. America’s aged population will continue to grow, outpacing the share of workers, but the way Americans save, consume, and spend will likely look different in 2043 compared to now. As such, there may not be an inevitable crisis at hand.

“Demographics aren’t destiny when it comes to this,” Eppsteiner says. “We have the ability to make policy choices to mitigate the challenges that the aging population poses. We shouldn’t assume that just because we had a baby boom, the baby boom is going to pass into retirement and that we’re sort of stuck. Because there are things that we can do.”